Ex-Canada PM calls on parties to end ties with separatist forces targeting India | World News – Hindustan Times Hindustan Times

source

The Spotlight Is on Medicaid Cuts, But the ACA Marketplaces Could See a One-Third Cut in Enrollment – KFF

The independent source for health policy research, polling, and news.

The independent source for health policy research, polling, and news.

Drew Altman

Published:  While all eyes are on the big Medicaid cuts being proposed in the House, significant changes are also being proposed that together would dramatically reduce enrollment in the ACA Marketplaces. So far, the Marketplace changes have received comparatively little attention even though they could reduce enrollment by about one third, driving up the number of uninsured in the country. The inside health policy world is aware of these changes, but the news media and the general public are so far unaware of the train heading for the ACA Marketplaces.

While all eyes are on the big Medicaid cuts being proposed in the House, significant changes are also being proposed that together would dramatically reduce enrollment in the ACA Marketplaces. So far, the Marketplace changes have received comparatively little attention even though they could reduce enrollment by about one third, driving up the number of uninsured in the country. The inside health policy world is aware of these changes, but the news media and the general public are so far unaware of the train heading for the ACA Marketplaces.

Partly that’s because such a big impact on the Marketplaces would result from the combined effect of a number of changes rather than one big policy proposal attracting media and public attention, and many of the changes are technical and wonky, even if they are consequential. It works like this: Start with the expiration of the enhanced ACA tax credits. That’s not in the reconciliation bill, but they will expire automatically if Congress does not act to extend them this year, which will reduce Marketplace enrollment by 4.4 million, according to Trump Administration estimates. Then add provisions from the House reconciliation bill, which will adopt Trump administration regulations, reducing enrollment by another 2.2 million, according to CBO.

Add to that a series of proposals developed in the Ways and Means Committee (several discussed below), which could reduce enrollment by several million more (public estimates are not available yet). Add all that up and it’s easy to see why many Marketplaces believe they are facing a one-third drop in enrollment (about 8 million of the 24 million currently covered, if extrapolated nationally), once all these changes would be in place. Proportionately, that’s a much bigger enrollment and coverage loss than projected for Medicaid. For context, the 24 million people covered by the Marketplaces is slightly more than the number of people covered by the 40 states that have expanded Medicaid.

Some of the legislative language describing these policy changes is murky and the policies themselves are quite technical. It’s not entirely clear what is intended and unintended. But a cut in coverage even close to this magnitude in the Marketplaces would also result in financial hardship for millions of low-income people and destabilize some smaller state Marketplaces or possibly lead to them closing up shop. Marketplaces have to maintain a fixed operational structure to function (supported by plan payments to them, not government), so if enrollment falls too much, smaller Marketplaces in smaller states may no longer be viable.

Already an insurer in one state, Vermont, has filed 2026 rates projecting enrollment declines of 17% just from the loss of the enhanced tax credits alone. Again, the credits will expire this year unless they are extended and premium payments in the Marketplaces will rise, on average, by more than 75%. Some Marketplaces believe that enrollment could eventually fall by significantly more than one third, remembering that enrollment doubled after the enhanced tax credits were instituted.

One change originally proposed in the Ways and Means Committee would require that consumers making as little as about $15,000 a year pay the full premium for their policy while they go through a new, potentially lengthy manual process to determine their eligibility. Today, the process is more automated and there is a grace period while paperwork is cleared.

Another change in the bill would mandate a shorter enrollment period, cutting it in half in some states, while also limiting flexibility for enrollment procedures at the same time.

And a significant change would remove an existing limitation on consumers having to pay back tax credits at the end of the year if their income changes. While most people think of this as impacting people who end up making more money than they thought, in states that didn’t expand their Medicaid programs, consumers who accept Marketplace tax credits but end up making too little to qualify could end up owing back all the tax credits they received. In the largest non-expansion state, Texas, a consumer who thought they would make $15,500 a year but ended up making $14,500 could be required to pay back nearly $6,000 in tax credits.

This is a good example of the challenges assessing many of the proposed changes can pose. Few would be against accuracy in determining income and appropriate levels of government support. The policy can certainly be framed to sound entirely responsible. But then there is also reality. As a new KFF analysis shows, income for low-income people can be volatile, and many Marketplace consumers are in hourly wage jobs, run their own businesses, or stitch together multiple jobs, which makes it challenging, if not impossible, for them to perfectly predict their income for the coming year, which is why these repayments were capped in the ACA to begin with. That’s why at one and the same time, a responsible-sounding policy with reasonable goals can be unrealistic and even cruel in practice.

Finally, in one last example, the bill would also revoke eligibility for Marketplace tax credits from many categories of legal immigrants like refugees and asylees, who have been enrolled in Marketplaces since the ACA passed. This includes Afghan immigrants who were our allies. In addition to effectively eliminating coverage for more than a million legal immigrants, immigrant populations tend to be younger and use less health care than others. This might drive up premiums and increase rates in state individual markets that have been stable for years.

Taken together, these policy changes—many of which are obscure and in the weeds, but enormously important for people and the Marketplaces in every state—warrant much more sunlight with arguments for and against being carefully scrutinized. Of course, that can’t easily happen in a reconciliation process—big policy changes get swept up in a larger, fast moving legislative package with little public awareness of their consequences or as in this case, even that they are happening at all.

The CBO should also tread carefully, scoring the impact on coverage of new administrative policies that will work in combination and be hard for consumers to understand but significantly impact coverage and Marketplace operations. CBO does not usually provide ranges for their estimates but, if we were “scoring” this at KFF, I would insist on producing ranges, feeling a single number would assert certainty beyond what can reasonably be predicted.

View all of Drew’s Beyond the Data Columns

KFF Headquarters: 185 Berry St., Suite 2000, San Francisco, CA 94107 | Phone 650-854-9400

Washington Offices and Barbara Jordan Conference Center: 1330 G Street, NW, Washington, DC 20005 | Phone 202-347-5270

www.kff.org | Email Alerts: kff.org/email | facebook.com/KFF | twitter.com/kff

The independent source for health policy research, polling, and news, KFF is a nonprofit organization based in San Francisco, California.

Leave a Comment

Leave a Comment

Who Might Lose Eligibility for Affordable Care Act Marketplace Subsidies if Enhanced Tax Credits Are Not Extended? – KFF

The independent source for health policy research, polling, and news.

The independent source for health policy research, polling, and news.

Justin Lo and Cynthia Cox

Published:

Enhanced subsidies for Affordable Care Act (ACA) Marketplace plans are set to expire at the end of 2025, unless they are renewed by Congress. Since 2021, these enhanced subsidies have lowered monthly premium payments for the vast majority of Marketplace enrollees, across incomes. For example, instead of a lower-income person paying 2% of their income on their premium, they pay nothing. Higher income people currently pay no more than 8.5% of their income on their premium, whereas they were originally ineligible for financial assistance.

While virtually all subsidized ACA enrollees can expect to see their premium payments rise substantially without extension of these subsidies, most will still be eligible for some financial assistance (with the original ACA subsidies). However, those who earn more than four times the federal poverty level ($62,600 for an individual or $128,600 for a family of four with 2026 coverage) would lose eligibility for subsidies altogether and would therefore have to pay full price for their health plans. Based on 2025 premiums, for example, a 60-year-old couple earning $85,000 annually (416% of the federal poverty level in the contiguous 48 states), would see their monthly premium payment increase by $1,507 per month (an increase in payments of over $18,000 for the year), on average.

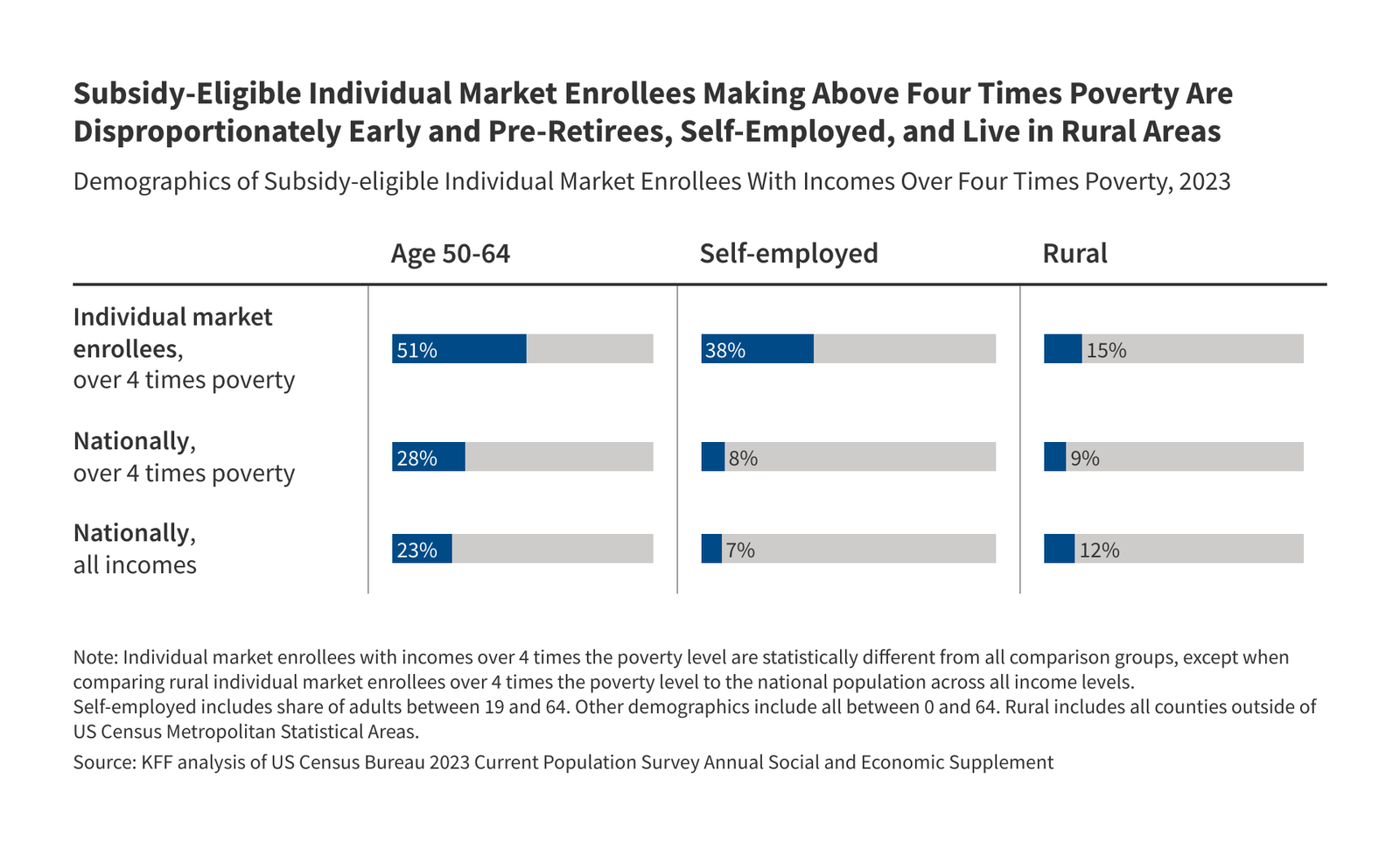

Relative to other Americans, subsidy-eligible individual market enrollees with incomes over four times poverty (who would lose subsidy eligibility if enhanced tax credits expire) are disproportionately:

Relatively few Marketplace enrollees have incomes above four times poverty. According to administrative data, in 2024, 7% of Marketplace enrollees reported an income over four times poverty, with 3% having an income between four and five times poverty and another 4% with incomes over five times poverty (another 4% did not have a known income and may have also exceeded four times the poverty level, but most likely are not receiving an advanced premium tax credit). However, before the enhanced subsidies were introduced – and particularly in 2017 when there were large premium increases and debates about repealing the ACA – this group of people with incomes over four times poverty were the focus of a great deal of media attention because they were fully exposed to the underlying premiums. For those who were priced out of coverage before the enhanced subsidies, they often faced a choice of being uninsured, or – if they were healthy enough to qualify – buying a short-term (non-ACA-compliant) plan off of the Marketplace.

Note: The data above is based on KFF analysis of the 2024 Current Population Survey Annual Social and Economic Supplement. The analysis includes people under age 65 who buy individual market insurance, are subsidy eligible, and would receive a subsidy based on household income. Household offer units were imputed as described previously; enrollees were considered not subsidy eligible if a member of the unit reported being offered employer-sponsored insurance.

KFF Headquarters: 185 Berry St., Suite 2000, San Francisco, CA 94107 | Phone 650-854-9400

Washington Offices and Barbara Jordan Conference Center: 1330 G Street, NW, Washington, DC 20005 | Phone 202-347-5270

www.kff.org | Email Alerts: kff.org/email | facebook.com/KFF | twitter.com/kff

The independent source for health policy research, polling, and news, KFF is a nonprofit organization based in San Francisco, California.

Leave a Comment

How to build strong foundations for economic growth in the AI era – ft.com

By the end of the decade, artificial intelligence will contribute $20tn (£16tn) to the global economy, driving 3.5 per cent of global GDP according to a recent report by IDC.

AI and accelerated computing are transforming industries like healthcare, retail, banking, customer service, and manufacturing at an exceptional pace, with every dollar spent on AI generating $4.60 (£3.67) into the global economy.

Behind this phenomenal growth are two key pillars for continued success: AI skills training and ecosystem support.

Technology is evolving at an unprecedented pace, making continuous learning essential for organisations to stay at the forefront of innovation.

The rapid adoption of AI and accelerated computing have fuelled the need for a skilled workforce adept at leveraging these platforms to create solutions that positively impact society. AI leaders expect that AI will not replace the work of humans, but will assist them in their daily jobs instead – leading to more efficient and productive results.

According to the World Economic Forum’s 2025 Future of Jobs Report, big data specialists and artificial intelligence/machine learning experts top the list for fastest-growing roles globally, with AI predicted to create 11mn new jobs.

Training and upskilling is essential to progressing in the AI-driven world. Although the material may be complex, finding the opportunities to learn is not.

NVIDIA’s Deep Learning Institute, launched in 2016, equips people with the critical skills to navigate and lead the technology-driven future. AI education is more than a pathway to innovation – it’s a foundation for solving some of the world’s most pressing challenges.

Ten years prior, CUDA was created – a computing platform that can leverage the power of GPUs for accelerated general-purpose computing – which fast became the foundation of the GPU computing system. Every GPU application and framework uses CUDA, meaning a thorough understanding is fundamental for any AI developer.

Equipping developers with these opportunities to explore, understand and create with AI can help lead to professional advancement in a variety of areas, including medicine, engineering and more. A 2023 study by the University of Oxford found that workers with AI skills command salaries approximately 21 per cent higher than their peers, with potential increases of up to 40 per cent.

AI learning is becoming more prevalent in higher education, with universities now using AI to enhance accessibility, innovate teaching methods, and future-proof their curricula. Across Europe, the Middle East and Africa, universities from many countries are leveraging AI to provide innovation in education and research, benefiting faculty and students with the value of AI assistance.

AI is already becoming part of the classroom, thanks to education innovators like Evoke AI. A startup and member of NVIDIA Inception, their technology transforms lessons from textbook-based theory into vibrant, interactive scenarios to make learning engaging and relevant, bridging the gap between knowledge, student and teacher.

At NVIDIA’s GTC in March 2025, developers can enhance and build their skills by taking part in new training labs, workshops, self-paced courses, and professional certifications spanning key areas like accelerated data science and agentic AI.

At the heart of AI’s engine of global economic growth is the need for robust, open source AI infrastructure, along with an ecosystem of startups and developers to harness the potential of AI. Open source AI models and tools are fundamental for the ecosystem, enabling innovation, agility, better and faster problem-solving, and increased security.

Many European countries are now seeing the value in developing and deploying AI using their own infrastructure, data, workforce, and networks – also known as sovereign AI. By building AI infrastructures, countries are creating environments for AI to thrive. They can foster local startups, attract global talent and partnerships for their research hubs, spur new businesses by entrepreneurs, and speed development of AI-accelerated applications tailored to key markets, which can bolster global competitiveness and have long-term positive impact on GDP. By providing compute and training resources for their local ecosystems, countries are equipping researchers, innovators, and startups with critical tools to combat climate change, boost energy efficiency, and protect against cybersecurity threats.

AI infrastructure is the fabric for innovative, risk-taking startups, developers and researchers. By giving them cost-effective access to cloud platforms, high-quality open source AI models and tools, and access to high-performance hardware, startups can focus resources on innovation and scale rapidly. It allows them to access accelerated computing, create applications, implement use cases, and drive growth.

Technology isn’t only being democratised at country-level, but at a community level too. AI startup accelerator programs like NVIDIA Inception, Microsoft for Startups, and Google for Startups to name but a few are providing startups with access to resources like technical tools and training, hardware, and subject matter experts to scale quickly.

Adding $20tn to the global economy in the next five years isn’t surprising when AI is creating entirely new sectors that simply didn’t exist a decade ago. Emerging markets such as autonomous vehicles, smart factories, and personalised healthcare need strong AI foundations to thrive. Organisations are creating new job opportunities with smarter products and services and new business models, and are increasing overall profitability by reducing operating costs through efficiencies created by AI.

The landscape of technology is changing, quickly. Every day, new advancements are made, new technologies are invented, and new skills are ready to be learned.

Leave a Comment

Leave a Comment

Mortgage Rate Trends And Predictions For June 5 – 11, 2025 – Bankrate

Compare accounts

Get guidance

Compare accounts

Get guidance

Money market accounts

Money market accounts are similar to savings accounts, but offer some checking features as well.

Get guidance

Banking

Unlock financial rewards by signing up for a savings or checking account with a bonus offer.

Get guidance

Compare rates

Get guidance

Compare rates

Get guidance

Buying & selling

Find an expert who knows the market. Compare trusted real estate agents all in one place.

Get guidance

Compare investments

Get guidance

Compare plans

Get guidance

Finding an advisor

Get guidance

Compare cards

Find my matches

See your card matches

Answer a few quick questions and we’ll show you your top credit card options.

Compare cards

See what the experts say

Read in-depth credit card reviews to find out which cards have the best perks and more.

Get guidance

Get advice

Build credit

Compare lenders

Get guidance

Compare lenders

Get guidance

Compare lenders

Get guidance

Compare lenders

Get guidance

HELOC

A HELOC is a variable-rate line of credit that lets you borrow funds for a set period and repay them later.

Home equity basics

Home equity loans

Home equity loans let you borrow a lump sum at a fixed rate, based on how much of the home you own outright.

Get guidance

Compare rates

Popular states

Compare rates

Popular states

Compare rates

Get guidance

Calculators

Get guidance

You have money questions. Bankrate has answers.

Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or when you click on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. However, this compensation in no way affects Bankrate’s news coverage, recommendations or advice as we adhere to strict editorial guidelines.

Our advertisers do not compensate us for favorable reviews or recommendations. Our site has comprehensive free listings and information for a variety of financial services from mortgages to banking to insurance, but we don’t include every product in the marketplace. In addition, though we strive to make our listings as current as possible, check with the individual providers for the latest information.

Experts say rates will…

Rates are likely to drop in the coming week, according to the majority of ratewatchers polled by Bankrate.

Of those polled, 56 percent of respondents predict rates will drop, and 44 percent predict rates won’t change. No one expects rates to rise in the coming week.

The average 30-year fixed rate was 6.89 percent as of June 4, according to Bankrate’s national survey of large lenders, down slightly from 6.94 the previous week.

Estimate your monthly mortgage payment based on current rates using this calculator.

Rate Trend Index

Week of June 5 – 11, 2025

Experts say rates will…

Going into the new week, I expect to see favorable rates. If you’re doing a loan, do not gamble; lock now. We are in a good spot!

Michael Becker

Branch Manager, Sierra Pacific Mortgage , White Marsh , MD

If Friday's non-farm payroll report shows weakness similar to what today’s ADP payroll report showed, bonds will rally. After two weak ADP reports, I expect the report this Friday will disappoint and bonds will rally, and we will have lower mortgage rates next week.

Melissa Cohn

Regional Vice President, William Raveis Mortgage

Mortgage rates will get some relief this week thanks to the much weaker ADP jobs report. Of course, the government jobs report on Friday could be a game-changer if it is not a weak report as well. New tariffs on steel will check any real improvement in rates as the higher prices signal a warning sign for inflation.

Heather Devoto

Vice President, Branch Manager, First Home Mortgage , McLean , VA

I'm looking for rates to decline in the week ahead as market participants continue to evaluate the labor market and the impact of trade policy on the global economy.

Ken Johnson

Walker Family Chair of Real Estate, University of Mississippi

On May 2, the 10-year Treasury closed with a yield of 4.32 percent. On May 21, it closed at a yield of 4.60 percent. On June 3, the market opened at a yield of 4.45 percent. Before May 21, yield movements were mostly up. After May 21, yield movements were mostly down. Bond yields are highly correlated with mortgage rates, making this mortgage rate call pretty much a toss-up. Call me an optimist. I am going with the more recent trend. Next week, long-term mortgage rates will follow the more recent trend in the 10-year and go down, if only slightly.

Dr. Anthony O. Kellum

President & CEO, Kellum Mortgage , Roseville , MI

It's still a bit early to say definitively, but I believe rates are likely to head down as we move into summer. Market momentum and recent signals suggest a shift toward easing, which could be promising for both buyers and homeowners looking to refinance. Recent forecasts indicate that mortgage rates may decline modestly in the latter half of 2025. For instance, Fannie Mae projects rates to end the year around 6.3 percent, down from current levels near 7 percent. This anticipated decrease is based on expectations of slower economic growth and easing inflation, which could prompt the Federal Reserve to lower interest rates.

Jeff Lazerson

President, MortgageGrader

Down — private sector jobs report was abysmal.

Richard Martin

Director of Home Lending, Curinos

In terms of this week, expect rates to end the week lower on the heels of a disappointing employment report Friday and downward revisions from prior months.

Greg McBride, CFA

Chief Financial Analyst, Bankrate , North Palm Beach , FL

A slowdown in the labor market would help bond yields and mortgage rates, but just a little bit. We’re not going to see a plunge in mortgage rates until inflation risks are off the table.

Denise McManus

Global Real Estate Advisor, Engel & Voelkers & Senior Lender, Xpert Home Lending, Engel & Voelkers

Going into the new week, I expect to see favorable rates. Again, no big swings but with a slight downward trickle and positive mindset, especially now that Fannie Mae has revised their position on rates and the housing market for the remainder of 2025. If you’re doing a loan, do not gamble; lock now. We are in a good spot!

Dick Lepre

Senior Loan Officer, Realfinity , Alamo , CA

Trend: Flat. Yields on fixed-income securities continue to be boringly flat. Look for 30-year fixed mortgages to stay in the 6.875 to 7.0 percent range.

Joel Naroff

President and Chief Economist, Naroff Economic Advisors , Holland , PA

With promises of a phone call with [China's President] Xi hanging over the markets, expectations still run high despite past disappointments. They may not be met once again.

Mitch Ohlbaum

Mortgage Banker, Macoy Capital Partners , Los Angeles , CA

Unchanged. The 10-year treasury is currently trading at 4.41 percent and only down slightly from last week. There are economics pulling at both sides of the interest rate argument. On one side, you have job creation at the lowest in two years in May, following downward revisions from April. On the other side, you have concerns about inflation due to tariffs. The solid news is that unemployment has remained steady. I would not expect much change until the tariff issues have settled.

Les Parker, CMB

Managing Director, Transformational Mortgage Solutions , Jacksonville , FL

Mortgage rates will go nowhere. Here’s a parody of “Chains,” Nick Jonas' 2014 hit. “Range got bonds in chains. Range got bonds in chains with doves. The range wouldn't change. No, range wouldn't change for love.” With more data comes more confusion, which gives bonds room to go nowhere. However, a significant rise in oil prices would drive rates up.

Nicole Rueth

Market Leader, The Rueth Team of Movement Mortgage , Denver , CO

Rates are holding steady and bouncing inside a narrow band of uncertainty. This morning’s ADP report missed the mark and ISM growth metrics weakened, helping push rates down slightly. But inflation isn’t backing off, the ISM price index climbed again, adding to last month’s hot PPI reading. The Fed remains on the sidelines, watching the tug-of-war between slowing growth, easing labor and sticky inflation. Until one clearly breaks, rates are stuck…and so are we.

Sean P. Salter, Ph.D.

Associate Professor of Finance and Dale Carnegie Trainer, Middle Tennessee State University , Murfreesboro , TN

Unchanged. Chaos reigns at the moment. With all the uncertainty surrounding economic, geopolitical and social activity, I do not expect any participants to take significant action that would alter rates in the short term. The Big Beautiful Bill may be DOA and the U.S. Congress is backpedaling on DOGE cuts. Ukraine is pushing back hard on Russia, and it’s not clear what — if anything — Russia is going to do about it. I expect rates to remain relatively unchanged until the picture gets developed.

Robert J. Smith

Chief Economist, GetWYZ Mortgage

Rates will be relatively unchanged, barring any surprises on key economic data, employment data this Friday and inflation data next Wednesday.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Bankrate, LLC NMLS ID# 1427381 | NMLS Consumer Access

BR Tech Services, Inc. NMLS ID #1743443 | NMLS Consumer Access

© 2025 Bankrate, LLC. A Red Ventures company. All Rights Reserved.

Leave a Comment

Leave a Comment

Leave a Comment

Roundup of climate and environmental news to June 8, 2025 – Vancouver Sun

Here’s all the latest local and international news concerning climate change for the week of June 2 to June 8, 2025.

You can save this article by registering for free here. Or sign-in if you have an account.

Here’s the latest news concerning climate change and biodiversity loss in B.C. and around the world, from the steps leaders are taking to address the problems, to all the up-to-date science.

Subscribe now to read the latest news in your city and across Canada.

Subscribe now to read the latest news in your city and across Canada.

Create an account or sign in to continue with your reading experience.

Create an account or sign in to continue with your reading experience.

Check back every Saturday for more climate and environmental news or sign up for our Climate Connected newsletter HERE.

• Early-season wildfires of note continue to burn across Western Canada, causing evacuations, poor air quality

• How UBC’s sustainability hub is helping reduce embodied carbon in the construction industry

• Sunday is World Oceans Day. The AP reports on David Attenborough’s new documentary ‘Ocean.’

• There’s a wildfire crisis in Western Canada. Why is this happening so early in the season?

Human activities like burning fossil fuels and farming livestock are the main drivers of climate change, according to the UN’s intergovernmental panel on climate change. This causes heat-trapping greenhouse gas levels in Earth’s atmosphere, increasing the planet’s surface temperature.

Start your day with a roundup of B.C.-focused news and opinion.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of Sunrise will soon be in your inbox.

We encountered an issue signing you up. Please try again

Interested in more newsletters? Browse here.

The panel, which is made up of scientists from around the world, has warned for decades that wildfires and severe weather, such as B.C.’s deadly heat dome and catastrophic flooding in 2021, would become more frequent and intense because of the climate emergency. It has issued a code red for humanity and warns the window to limit warming to 1.5 C above pre-industrial times is closing.

According to NASA climate scientists, human activities have raised the atmosphere’s carbon dioxide content by 50 per cent in less than 200 years, and “there is unequivocal evidence that Earth is warming at an unprecedented rate.”

And it continues to rise. As of May 5, carbon dioxide in the atmosphere has risen to 429.64 parts per million, up from 428.15 parts per million last month and 427.09 ppm in March, according to NOAA data measured at the Mauna Loa Observatory, a global atmosphere monitoring lab in Hawaii. The NOAA notes there has been a steady rise in CO2 from under 320 ppm in 1960.

• The Earth is now about 1.3 C warmer than it was in the 1800s.

• 2024 was hottest year on record globally, beating the record in 2023.

• The global average temperature in 2023 reached 1.48 C higher than the pre-industrial average, according to the EU’s Copernicus Climate Change Service. In 2024, it breached the 1.5 C threshold at 1.55 C.

• The past 10 years (2015-2024) are the 10 warmest on record.

• Human activities have raised atmospheric concentrations of CO2 by nearly 49 per cent above pre-industrial levels starting in 1850.

• The world is not on track to meet the Paris Agreement target to keep global temperature from exceeding 1.5 C above pre-industrial levels, the upper limit to avoid the worst fallout from climate change including sea level rise, and more intense drought, heat waves and wildfires.

• On the current path of carbon dioxide emissions, the temperature could increase by as much 3.6 C this century, according to the IPCC.

• In April, 2022 greenhouse gas concentrations reached record new highs and show no sign of slowing.

• Emissions must drop 7.6 per cent per year from 2020 to 2030 to keep temperatures from exceeding 1.5 C and 2.7 per cent per year to stay below 2 C.

• There is global scientific consensus that the climate is warming and that humans are the cause.

(Source: United Nations IPCC, World Meteorological Organization, UNEP, NASA, climatedata.ca)

Wildland firefighters battling a blaze in northeastern B.C. were preparing for a challenging weekend as strong winds could push flames closer to the small community of Kelly Lake, about 80 kilometres south of Dawson Creek.

Karley Desrosiers, a fire information officer with the B.C. Wildfire Service, told a news conference Friday that strong southwest winds the day before had pushed the Kiskatinaw River fire north and south of Kelly Lake.

While the flames didn’t reach the community of about 75 residents, an eight-to nine-kilometre stretch crossed over the Alberta boundary, she said.

A cold front Friday, which was forecast to begin around 5 p.m., was expected to shift what she called “strong, erratic, gusty winds.”

“So the wind will be pushing the fire from the northwest towards the southeast,” she said. “So (with) the wind pushing the fire from the north, there is the potential for that flank that’s adjacent to the community, north of Kelly Lake, to move more toward the community.”

Read the full story here.

—The Canadian Press

Poor air quality fuelled by wildfires burning across the Prairies left a large swath of the country enveloped in a haze for another day.

Parts of Alberta, British Columbia, Manitoba, New Brunswick, Ontario, Quebec, Saskatchewan, and Newfoundland and Labrador were experiencing poor air quality and reduced visibility due to the wildfires, a situation expected to continue through Sunday.

Much of southern Ontario was under an air quality statement on Thursday and Friday that lifted early Saturday morning.

Environment Canada meteorologist Jean-Philippe Begin says there’s some good news — a low pressure system passing through the Prairies, currently in Northern Saskatchewan and expected to move into Manitoba and Northwestern Ontario by Monday, is expected to bring precipitation for areas hit by out-of-control forest fires.

That system is not expected to bring much relief in Northern Alberta, however, where there is little rain in the forecast.

Read the full story here.

—The Canadian Press

Some Manitoba residents who have taken refuge in Niagara Falls, Ont., after fleeing wildfires raging in their province say they’re grateful for the hospitality but worry they won’t have a home to return to once the flames die down.

Kelly Ouskun says he saw so much fire and smoke along the highway on the drive from his family’s home in Split Lake to Thompson, about 145 kilometres away, that he felt “nauseated” and his eyes hurt.

The family flew to Niagara Falls from there and he says they’ve now settled in at one of the five downtown hotels taking in evacuees, while hanging on to hope that what he’s heard about his home — that it’s still standing and intact — is true.

More than 18,000 people have been displaced due to the wildfires in Manitoba since last week, including 5,000 residents of Flin Flon near the Saskatchewan boundary, along with members from at least four First Nations.

Read the full story here.

—The Canadian Press

Canada lacks national regulations to assess the construction industry’s embodied carbon, the total greenhouse-gas emissions associated with a product’s life cycle.

However, a team at the University of B.C.’s sustainability hub aims to change that, and help the federal government meet its net-zero emissions targets by 2050 in an effort to limit global warming.

The hub led a two-year project to tackle the challenges of reducing embodied carbon emissions in construction projects — everything from material extraction and transportation to construction of buildings and disposal of materials — and provide solutions.

Ottawa is planning to update its national building model code with a phased in plan for industry to disclose the embodied carbon footprint of buildings, and the hub’s research will influence those decisions.

A report from one of the hub’s research teams, expected to be made public in a couple of weeks, will make recommendations to Canada’s net-zero advisory body, a group that advises Environment and Climate Change Canada on how to achieve the country’s climate goals.

One of the recommendations will be to develop a national standard on reporting embodied carbon and to create a national database that can be used by local governments and industry, said Megan Badri, research manager at the UBC sustainability hub.

Read the full story here.

—Tiffany Crawford

An ominous chain unspools through the water. Then comes chaos. A churning cloud of mud erupts as a net plows the sea floor, wrenching rays, fish and a squid from their home in a violent swirl of destruction. This is industrial bottom trawling. It’s not CGI. It’s real. And it’s legal.

“Ocean With David Attenborough” is a brutal reminder of how little we see and how much is at stake. The film is both a sweeping celebration of marine life and a stark exposé of the forces pushing the ocean toward collapse.

The British naturalist and broadcaster, now 99, anchors the film with a deeply personal reflection: “After living for nearly a hundred years on this planet, I now understand that the most important place on Earth is not on land, but at sea.”

The film traces Attenborough’s lifetime — an era of unprecedented ocean discovery — through the lush beauty of coral reefs, kelp forests and deepsea wanderers, captured in breathtaking, revelatory ways.

But this is not the Attenborough film we grew up with. As the environment unravels, so too has the tone of his storytelling. “Ocean” is more urgent, more unflinching. Never-before-seen footage of mass coral bleaching, dwindling fish stocks and industrial-scale exploitation reveals just how vulnerable the sea has become. The film’s power lies not only in what it shows, but in how rarely such destruction is witnessed.

“Ocean” premieres Saturday on National Geographic in the U.S. and streams globally on Disney+ and Hulu beginning Sunday.

Read the full story here.

—The Associated Press

With no new big dams of its own to build, B.C. Hydro on Wednesday threw open a window for private developers to propose new sources of ‘baseload’ power to back up the growing list of renewable electricity proposals it’s enlisting to expand the province’s grid.

‘Baseload’ refers to sources of power utilities can turn on or off as needed, such as B.C. Hydro’s existing dams. With this, Hydro is considering possibilities for geothermal, pump-storage hydro or even grid-scale batteries as a means to meet peak demand when intermittent wind and solar sources are less reliable.

B.C. Energy Minister Adrian Dix didn’t put a number on the amount of electricity Hydro might be looking for in a request for expressions of interest, just that “we want to see what’s out there and get those proposals in place.”

Dix, however, characterized the step as “a moment when we have to build again to diversify, to build the economy and to create wealth,” not dissimilar to the period of B.C.’s dam-building boom in the 1960s and 1970s.

“We’ve got to build out clean electricity, which is one of our significant economic advantages in B.C.,” he said.

Read the full story here.

—Derrick Penner

The stretch of the Alaska Highway near Fort Nelson that closed Monday due to a nearby wildfire has reopened to single lane traffic.

The B.C. Wildfire Service says the blaze is about 26 square kilometres in size and is burning out of control about 10 kilometres northeast of Summit Lake.

It is one of two “wildfires of note” in the province and prompted the Northern Rockies Regional Municipality to issue an evacuation alert on Monday for the Tetsa River Area.

The wildfire service’s latest update says the so-called Summit Lake fire “experienced significant overnight growth” between Sunday and Monday and “continues to display aggressive fire behaviour,” growing towards Highway 97.

Read the full story here.

—The Canadian Press

In the spring of 2024, Sukhdeep Brar, a second-generation stone-fruit grower in Summerland, couldn’t even look at his cherry trees. After a deep winter freeze decimated his crops, the branches stood bare — no buds, no blossoms, no harvest.

“I didn’t want to go out into the orchard,” he said. “It was just so depressing.”

But this April, something shifted. In the first week of the month, Brar said he walked through his Summerland property and found a welcome sight — thousands of delicate pink-and-white blossoms.

“It’s a relief to see all my trees flowering again,” said the orchardist, who has grown cherries, peaches, plums, prunes, apricots and nectarines on his family farm for decades.

Last season, Brar’s 150-acre orchard was left completely barren after temperatures plunged to nearly -30C in January, killing buds and wiping out entire crops.

While there will be lots of cherries this year, the long-term picture remains uncertain. Many farmers say their future is hanging by a thread — squeezed by rising debt, climate volatility, and a market that often favours cheaper imported fruit over homegrown harvests.

Read the full story here.

—Sarah Grochowski

It’s not yet summer, but out-of-control wildfires are raging across Western Canada, fuelled by drought, warmer temperatures and lack of rainfall.

Residents in northeastern B.C., near Kelly Lake, have fled their homes, as Manitoba and Saskatchewan declared provincial emergencies this week.

As of Friday, wildfires in Manitoba had displaced more than 17,000 people. Thousands more have been given evacuation orders because of wildfires in Saskatchewan and Alberta, including 1,300 residents of Swan Hills, a community northwest of Edmonton.

Why are there so many fires burning in Western Canada?

The majority of wildfires are in boreal forests, the Northern forests, and the whole region has had very warm conditions, high pressure and hot temperatures, said Lori Daniels, a professor in UBC’s Department of Forest and Conservation Sciences.

“In some places, they’ve been breaking records. So it’s brought early spring heat and with that, of course, very low humidity and no rain,” she said. “So it looked like a good start to summer, except it’s dried out our forests.”

Daniels added that many of the areas also had low snow packs this year, so there wasn’t enough snow to melt and saturate the ground.

Read the full story here.

—Tiffany Crawford

While images of wildfires capture their ferocity, data can provide insight into how bad a fire season is.

Such is the case with two graphics, powered by satellite data, that showcase a Canadian wildfire season off to a wild — and scary — start.

Twice a day a NASA satellite sends images to the ground, giving a real-time view of where fires are burning. This is especially useful for remote areas where no sensors are stationed.

As of Tuesday that satellite had picked up four times as many fire hot spots across Canada than is typical for early June. That’s more than any year since the satellite began transmitting in 2012, except 2023, according to data from Global Forest Watch.

Though the satellite has recorded thousands of hot spots so far this year, that does not mean there are actually that many active fires. Each hot spot could be detected repeatedly over the course of days. And because each detection is about the size of 26 football fields, it can represent part of a much larger blaze, said James MacCarthy, wildfire research manager at Global Forest Watch.

Read the full story here.

—The Associated Press

365 Bloor Street East, Toronto, Ontario, M4W 3L4

© 2025 Vancouver Sun, a division of Postmedia Network Inc. All rights reserved. Unauthorized distribution, transmission or republication strictly prohibited.

This website uses cookies to personalize your content (including ads), and allows us to analyze our traffic. Read more about cookies here. By continuing to use our site, you agree to our Terms of Use and Privacy Policy.

You can manage saved articles in your account.

and save up to 100 articles!

You can manage your saved articles in your account and clicking the X located at the bottom right of the article.