Thank you for visiting nature.com. You are using a browser version with limited support for CSS. To obtain the best experience, we recommend you use a more up to date browser (or turn off compatibility mode in Internet Explorer). In the meantime, to ensure continued support, we are displaying the site without styles and JavaScript.

Advertisement

Scientific Reports volume 14, Article number: 27370 (2024)

Metrics details

Financial, material, and social assets are core drivers of access to salutary resources. However, there is a paucity of research about how non-income financial assets shape mental health. We explore the relation of financial assets with symptoms of depression and of anxiety using a nationally representative, longitudinal survey of U.S. adults fielded annually from 2020 to 2023 (n = 1,296 unique participants). We used multivariable logistic regression models to estimate the association of financial assets and financial stress separately and together with symptoms of depression (PHQ-9 > 9), anxiety (GAD-7 > 9), and their co-occurrence, controlling for demographic indicators and year fixed effects. We found, first, that adults with <$5,000 in accrued financial assets reported over two times the odds of positive screen for depression, anxiety, and co-occurring depression and anxiety, respectively, as adults with ≥$100,000 in financial assets. Second, when controlling for accrued financial assets, annual household income was not associated with symptoms of anxiety. Third, the gap in positive screen for depression between household financial assets groups stayed consistent and did not differ significantly over the study period. Annual income alone does not capture the influence of all financial assets on mental health.

High rates of depression and anxiety are a hallmark of America’s health in the twenty-first century. Depression and anxiety have been on the rise for over 15 years1,2, and increased further during the COVID-19 pandemic3,4,5. Over 21 million U.S. adults reported at least one major depressive episode in 20216, representing 8.3% of Americans. As of October 2023, 22.8% of U.S. adults reported frequent depressive symptoms and 29.5% reported frequent anxiety symptoms7. Symptoms of depression include depressed mood or loss of pleasure in activities as examples8. Symptoms of generalized anxiety include restlessness, feeling tense or on edge, or an inability to focus or concentrate9. Both can lead to limitations in function, loss of productivity, and behaviors that contribute to accumulating comorbidities and premature death10. Depression and anxiety can be debilitating10, reduce productivity10,11, and reduce quality of life12,13. While it is estimated that depression costs the U.S. $326.2 billion11 and anxiety costs the U.S. $33.71 billion14, the true costs to individuals, their families, their employers, and their communities is unknown.

Mental health is responsive to economic and social factors15,16,17,18. There is a well-defined income gradient with mental health:19,20 adults with higher income report lower levels of depression and anxiety than counterparts with lower income6,19,21,22. Positive income shocks have been linked with improvements in mental health23. For example, increases in social security payouts were associated with improvements in mental health for older women in the U.S.; similarly, improvements in mental health have been documented following winning the lottery24. Conversely, income loss is associated with poorer mental health and may have a stronger effect than increases in income on mental health25. Potential mechanisms of how income shapes mental health include increasing access to resources that improve overall health including mental health, providing control over one’s time and environment, and reducing stressors. Income alone, however, may not fully describe a person’s access to financial resources. Financial assets may include other financial resources beyond income such as savings, credit, and debt26,27. Together, these financial assets contribute to a holistic understanding of wealth that in turn shapes health28.

Wealth, defined broadly as total assets a given person or household has, may better protect mental health than income. Whereas income represents a flow of capital, wealth represents an accumulated stock of capital29. Even more than income, wealth represents more holistic access to resources that may improve or protect mental health. Wealth gaps, rather than income gaps, may better describe economic disparities30, including intergenerational transfers, that drive access to resources that can then result in differential mental health31. However, wealth is far less studied than income as a driver of health and mental health due in part to the difficulty of measuring wealth. A growing literature suggests that wealth is associated with mental health above and beyond income31,32,33. A systematic review of articles published between 1990 and 2006 on studies measuring wealth as an independent variable and health as a dependent variable produced 29 articles31. Among those studies, most reported a significant association between wealth and health, even when controlling for other measures of socioeconomic status such as income or education. A systematic review of articles on wealth and depression from inception through July 19, 2020 identified 96 articles34. More than half of included articles reported a significant association of wealth with depression. Before the pandemic, having accrued household financial assets below $20,000 was associated with 50% greater odds of reporting depressive symptoms than having more than $20,000 in financial assets, after adjusting for income and other socio-demographic characteristics32. Studies conducted during the early pandemic showed that having less than $5,000 in household financial assets was associated with 50% greater odds of reporting symptoms of depression in 20203, but no greater odds of persistent depression in 2021 in fully adjusted models27. Despite being a more holistic summary of capital and the accumulation of financial assets over time through potentially multiple sources, wealth is understudied relative to other socioeconomic measures such as income, education, and marital status. In a systematic review of articles on depression and assets during the COVID-19 pandemic, among 41 articles included in the review, 34 reported findings on depression and income while only 4 reported findings on wealth and depression35.

It is possible that the relationship between income and mental health differs from that between accrued financial assets and mental health. For example, two people with the same income may both lose their jobs. If one has other financial assets to fall back upon (accrued through, say, inherited wealth or ability to save more money after expenditures) then that person may have a very different psychological trajectory than the person who does not have a stock of financial assets to fall back on. Having a stock of financial assets, instead of merely a flow, can provide psychological safety, the ability to pay for expenses and maintain lifestyle in the face of changing income, and may represent broader comfort in the assurance of ability to control one’s environment, choices, and circumstances.

Another mechanism by which having fewer financial assets affects mental health may be through the experience of financial stress. Life stressors can harm mental health and financial stress is a particularly common stressor36,37,38. In a scoping review of 58 longitudinal studies exploring the relation between financial stress and depression, 83% of articles reported a significant association between financial stress and higher burden of depression39. Chronic exposure to stress can reduce people’s coping strategies and psychological well-being40. Additionally, experiencing financial stress may reduce one’s resources and cognitive bandwidth for decision making, which could result in behaviors that harm mental health41. Stressors exist separately from income and wealth; indeed in studies comparing objective financial indicators (e.g., income) and subjective financial indicators (e.g., financial stress), financial stress was a robust predictor of worsening depression and anxiety even when controlling for objective financial indicators42.

Understanding key drivers of mental health can inform policy efforts to prevent worsening mental health and target interventions to reduce the burden of mental illness and reduce mental health disparities across economic groups. This paper is one of the first, to our knowledge, to assess the association of savings with mental health longitudinally since the beginning of the COVID-19 pandemic, to assess the changes in the association of savings with mental health over time, and to do so using full-scale screeners for depression and anxiety (PHQ-9, GAD-7, respectively). The study aimed to address the following two questions: (1) What was the relationship of wealth with depression and anxiety from 2020 to 2023? (2) Did the association between wealth and mental health grow over time?

The CLIMB study is a nationally representative longitudinal survey of U.S. adults aged 18 and older, fielded via the AmeriSpeak panel. The AmeriSpeak panel, a probability-based sample of U.S. households randomly selected from the NORC National Frame that covers approximately 97% of U.S. households, served as the sampling frame. Eligibility for participation in the CLIMB study was limited to English-speaking AmeriSpeak panelists who had completed a survey within the preceding 6 months. The CLIMB study is comprised of four survey waves fielded during the COVID-19 pandemic: Wave 1 (March 2020 – April 2020), Wave 2 (March 2021 – April 2021), Wave 3 (March 2022 – April 2022), and Wave 4 (March 2023–April 2023).

To be included in the analytic sample, first, we subset to participants who responded to Wave 1 and at least one additional survey wave (Wave 2, Wave 3, or Wave 4) (n = 1,297). Then we dropped participants who were missing all responses to the Patient Health Questionnaire-9 (PHQ-9), a measure of depressive symptoms43, and the Generalized Anxiety Disorder-7 (GAD-7), a measure of symptoms of anxiety44, at all waves that they participated in the CLIMB Study (n = 1). This led to wave specific samples of: Wave 1 (n = 1,296); Wave 2 (n = 1,182); Wave 3; (n = 1,093); Wave 4 (n = 938). Post-stratification weights were constructed and applied to ensure the alignment of the CLIMB sample with the U.S. adult population, via benchmarking to the Current Population Survey.

To measure depressive symptoms, we used the 9-level version of the Patient Health Questionnaire (PHQ-9), which is scored on a range of 0–27, where a score of 10 or higher acts as a clinical threshold indicator of moderate to severe symptoms43. To measure symptoms of anxiety, we used the generalized anxiety disorder-7 (GAD-7), which is scored on a range of 0–21, and has a clinical threshold of 1044. Both measures have been clinically validated43,44, and are often used in primary care settings as screening tools ahead of formal diagnosis of depression and anxiety. Last, we documented the co-occurrence of elevated symptoms of depression and anxiety, which was defined by a positive screen for depression (PHQ-9 ≥ 10) and anxiety (GAD-7 ≥ 10) within the same person.

Financial assets were measured categorically at the household level and included annual income ((:<)$35,000, $35,000-$64,999, $65,000-$99,999, or (:ge:)$100,000), accrued financial assets ((:<)$5,000, $5,000-$34,999, $35,000-$64,999, $65,000-$99,999 or (:ge:)$100,000), and total debts (no debt, $1 – $19,999, (:ge:)$20,000), consistent with other publications45,46,47,48. Accrued financial assets refer to the total amount of funds across different accounts that adults have been able to save (i.e., funds left after expenses are deducted from income flows49). The question to determine total accrued financial assets in the CLIMB study was modified from a question asked in the National Health and Nutrition Examination Survey about total household savings: “We will now ask about household savings. By savings we mean money in all types of accounts, including cash, savings, or checking accounts, stocks, bonds, mutual funds, retirement funds (such as pensions, IRAs, 401Ks, etc.), and certificates of deposit. What category best represents how much money your household (including yourself) has in savings?”

Financial stress was defined as an indicator variable coded as 1 if respondent reported experiencing stress due to at least one of the following items in the previous 12 months: job loss, household job loss, financial problems, or difficulty paying rent. In sensitivity analyses we also deconstructed this indicator variable by each stressor.

To account for non-financial pandemic-related stress we constructed an indicator of social-emotional stress, defined by whether the respondent reported experiencing stress from loneliness, relationship problems, the death of someone close, or childcare problems. We used components of the stressors asked in all waves.

Several demographic variables were constructed, including a categorical age variable (18–29, 30–44, 45–59, (:ge:)60 years), a categorical race and ethnicity variable (non-Hispanic White, non-Hispanic Asian, non-Hispanic Black, non-Hispanic other, or Hispanic), an indicator for respondent sex (male, female), categorical variables of respondent marital status (married/living with partner, divorced/separated, never married) and education status (high school/General Educational Development (GED) or less, some college or vocational/associates degree, bachelor’s degree, or graduate/professional degree), an indicator for respondent employment status, the respondent’s region of residence (Midwest, Northeast, South, or West), health insurance (health insurance paid for by an employer or a union; health insurance you or your family pays for yourself; Medicaid; Medicare; no health care insurance; or some other kind of health insurance) and household size measured as the number of individuals living in the respondent’s home.

First, to describe the sample, we computed population-weighted proportions and unweighted frequencies for all covariates across each survey wave; aggregate frequencies and weighted proportions were also computed. We estimated the unadjusted relationship between each covariate and our three mental health indicators, respectively. We also mapped the frequency of positive screen for symptoms of depression, anxiety, and their co-occurrence at each wave in an Euler plot (Supplemental Fig. 1).

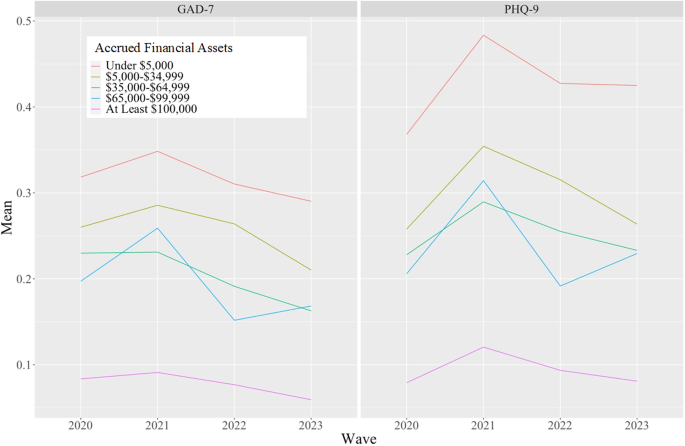

Second, to describe how outcomes evolved over the course of the pandemic and how they varied by key covariates, we computed the regression adjusted population-weighted prevalence of exceeding the clinical thresholds of the PHQ-9, GAD-7, and both by survey year and stratified by accrued financial assets. Weighted, adjusted probabilities were taken from multivariable logistic regressions.

Third, to estimate the contemporaneous association between accrued financial assets and the odds of exceeding clinical thresholds of the PHQ-9, GAD-7, or both, we used weighted logistic regression models with year fixed effects. Incorporating year fixed effects accounts for time-varying factors across the study period such as macroeconomic trends, and standard errors were clustered at the individual level to account for repeated measurement of individuals in our pooled cross-sectional sample. All models were adjusted for multiple covariates including contemporaneous age, race and ethnicity, sex, marital status, education status, employment status, region of residence, debt, income, health insurance, number of people in the household, and presence of pandemic-related past-year financial and social-emotional stress. Our estimation approach was selected for its robustness to the incidental parameters problem (relative to a model including individual fixed effects) and because it has been well established in the literature50,51,52. Our adjustment variable selection was guided by prior literature demonstrating important confounders17, and empirically corroborated by LASSO regression. We were primarily interested in the change in cross-sectional relationships between accrued financial assets and mental health in our study period, accounting for year-to-year variation but not within person changes across time.

To test for changes in the association of accrued financial assets with mental health over time, we conducted a longitudinal analysis that used the subsample of individuals who participated in each of the four survey waves (n = 824). We present the coefficients from the time interactions with accrued financial assets in the main text and for the whole model in the Supplemental Materials. All longitudinal analyses were estimated as hierarchical linear models (HLM).

We hypothesized (1) that the association between accrued financial assets and mental health would be stronger than the association between income and mental health given that wealth may confer more mental security than income, and (2) that the relationship between accrued financial assets and mental health would strengthen over time from 2020 to 2023.

To test the robustness of our results, several alternative model specifications and estimation techniques were considered. As assets are likely correlated, additional models of the relationship between PHQ-9, GAD-7, both PHQ-9 and GAD-7, and household income, accrued financial assets, and household debts, respectively, were also estimated to test sensitivity to multicollinearity. We also estimated a model in which the covariates “Financial Stress” and “Social-Emotional Stress” were decomposed into their constituent parts. To test sensitivity to continuous instead of binary operationalization of our mental health outcomes, we estimated additional models via ordinary least squares that use continuous measures of the PHQ-9 (range: 0–27) and GAD-7 (range: 0–21), respectively.

All analyses were conducted in R version 4.1.0, and all hypothesis testing was two-sided at a significance level of 0.05. Analyses were conducted in accordance with Strengthening the Reporting of Observational Studies in Epidemiology (STROBE) guidelines for reporting observational studies. All methods were performed in accordance with the relevant guidelines and regulations. The collection of data through the CLIMB study was deemed exempt by the Institutional Review Board (IRB) at NORC at the University of Chicago (IRB Protocol Number# 23-03-1219). As secondary analysis of de-identified data was performed in the study, the need of ethics approval was waived by the IRBs at Boston University Medical Campus (under IRB# H-39986) and Johns Hopkins Bloomberg School of Public Health (under IRB# 25544). Informed consent was obtained from all subjects to participate in the study.

Table 1 shows characteristics of the study sample across time. In 2023, 53.4% of the sample was female, 40.7% of the sample was 60 years or older, 68.2% of the sample was White, non-Hispanic, and 32.5% of the sample had accrued financial assets below $5,000. Missing values are reported in Table 1.

Supplemental Fig. 1 depicts the number of respondents who exceeded the clinical thresholds of the PHQ-9, the GAD-7, and their co-occurrence at each survey year. Co-occurrence of elevated depression or anxiety symptoms was more common than either alone. Supplemental Table 1 shows the associations between exceeding the clinical threshold of the PHQ-9, GAD-7, or both and each covariate individually controlling only for year fixed effects.

Figure 1 shows the weighted regression adjusted prevalence of positive screening for depression and anxiety by accrued financial assets group. Prevalence of positive screen for depression and anxiety was higher in groups with lower accrued financial assets.

Population-weighted regression adjusted probability of exceeding PHQ-9 or GAD-7 between 2020 and 2023, by accrued financial assets. “PHQ-9” indicates being at or above its clinical threshold of 10 out of a possible 27, reflective of having at least moderate depressive symptoms. Similarly, “GAD-7” indicates being at or above its clinical threshold of 10 out of a possible 21, reflective of having at least moderate symptoms of generalized anxiety. Probabilities taken from multivariable logistic regression with year fixed effects. Models employed a cluster-robust within-survey year estimator adjusted for individual characteristics. Survey weights used.

Table 2; Fig. 2 report the fully adjusted odds ratios of positive screen for depression, anxiety, or their co-occurrence controlling for concurrent respondent accrued financial assets and age, race and ethnicity, sex, region of residence, marital status, education, employment, income, debt, health insurance, household size, and past year stress (financial and social-emotional), and year fixed effects. Adults with under $5,000 relative to over $100,000 in accrued financial assets reported 2.19 (95% CI: 1.42, 3.39) times the odds of symptoms of depression, 2.05 (95% CI: 1.25, 3.36) times the odds of symptoms of anxiety, and 2.33 (95% CI: 1.38, 3.94) times the odds of co-occurring symptoms of anxiety and depression, when controlling for variables listed above. Income did not have a significant association with symptoms of anxiety but accrued financial assets did. Having $5,000-$34,999, $35,000-$64,999, $65,000-$99,999 in accrued financial assets was associated with 2.55 (95%CI: 1.56, 4.18), 2.40 (95%CI: 1.34, 4.27), and 2.99 (95%CI: 1.54, 5.80) times the odds, respectively, of screening positive for symptoms of anxiety or depression relative to $100,000.

Associations between accrued financial assets, income, debt, financial stress, and the odds of exceeding the clinical threshold of the PHQ-9, GAD-7, or Both. Note: Odds ratios (“OR”) and 95% CIs were estimated using logistic regression, adjusted for age, race and ethnicity, sex, education, employment status, health insurance, census region, marital status, employment, pandemic-related social emotional financial stress, and household size. All models were adjusted for time using with survey-year fixed effects and standard errors clustered at the individual level. Reference groups: Income: ≥ 100k, Accrued Financial Assets: ≥ 100k, Debt: No Debt. “PHQ-9“indicates being at or above its clinical threshold of 10 out of a possible 27, reflective of having at least moderate depressive symptoms. Similarly, “GAD-7” indicates being at or above its clinical threshold of 10 out of a possible 21, reflective of having at least moderate symptoms of anxiety. “Financial Stress” indicates respondent experienced any of the following: job loss, household job loss, financial problems, difficulty paying rent. Income, accrued financial assets, and debt were all measured at the household level. Hypothesis testing was two-sided, at a significance level of 0.05.

Finally, we tested for the change in the association of accrued financial assets and mental health over time (coefficients for accrued financial assets categories shown in Table 3 and full model output shown in Supplemental Table 4). In general, interactions between categories of accrued financial assets and survey waves were not statistically significant. For the two interaction terms that were statistically significant, hypothesis testing produced p-values > 0.05, suggesting no statistically significant difference in the association between variables over time. Thus, we did not find substantial evidence that the association of lower accrued financial assets with poorer mental health was time-varying.

Supplemental Table 2 show the odds of positive screen of depression (a), anxiety (b), and their co-occurrence (c) in models that control for income (without accrued financial assets or debt), accrued financial assets (without income or debt), and the final model that controls for debt (without income or accrued financial asset). Having less than $5,000 in accrued financial assets was associated with 2.91 times the odds of depression, 2.10 times the odds of anxiety, and 2.79 times the odds of their co-occurrence relative to having at least $100,000, when we did not control for income or debt.

Supplemental Fig. 2 shows the bivariable association of each financial or social-emotional stressor experienced in the last 12 months with positive screen for depression, anxiety, or both controlling only for year fixed effects: household job loss, difficulty paying rent, relationship problems, and loneliness were significantly associated with positive screen for depression; household job loss, financial problems, difficulty paying rent, death of someone close, relationship problems, and loneliness were significantly associated with positive screen for anxiety.

Supplemental Table 3 shows the adjusted relationship between accrued financial assets and mental health using continuous definitions of the PHQ-9 and GAD-7 (and linear regression). When using the continuous measures, patterns were largely consistent with main findings; adults with lower accrued financial assets had higher symptoms of depression and anxiety, respectively, indicative of more severe symptoms.

Using a nationally representative cohort of U.S. adults surveyed annually from Spring 2020 through Spring 2023, we found overall that persons with lower wealth (defined by accrued financial assets) reported more symptoms of depression than persons with more wealth and that these associations were consistent from 2020 to 2023. We found, first, that even when controlling for income, having higher accrued financial assets was associated with lower prevalence of depression, anxiety, and their co-occurrence, suggesting that wealth above and beyond income has a relationship with mental health. Adults with less than $5,000 in accrued financial assets reported higher odds of positive screen for depression, anxiety, and their co-occurrence, respectively, relative to adults with $100,000 or more. Second, consistent with our primary hypothesis, it was interesting that when controlling for accrued financial assets, income did not have a significant association with positive screen for anxiety. Third, we found that the significant association between wealth and mental health was consistent across the study period, and it did not grow over that time period. Our first hypothesis that accrued financial assets would be more strongly associated with anxiety and depression than income was supported partially by the results. Our second hypothesis that this relationship would grow over time was not supported by these findings; however, the relationship between financial assets and mental health did not weaken across time, suggesting a sustained association between these factors over the study period.

Our finding that wealth may matter more for mental health than income is consistent with some, but not other, findings. For example, in a study of Australian adults in 2002, wealth was determined to be at least as important as, if not more than, income in its association with well-being53. A more recent study of European countries using data collected from 2004 to 2017 identified that family assets played a protective role against depression and further that different assets mattered differently for mental health outcomes with liquid assets (such as total amounts in checking and savings accounts) mattering more than less liquid assets (such as stocks and bonds)54. In a study surveying European countries, income had a stronger relationship with mental health than wealth among retired people, although the magnitude of associations varied across country contexts, whereby wealth mattered less in countries with more generous social support55. In this way, it is possible that wealth plays a more important role in protecting mental health in places that have less generous social policies, where household assets must be used to cover expenses for basic needs.

This is one of the only studies, to our knowledge, to measure changes in the relation between non-income accrued financial assets and mental health indicators over time across all ages of U.S. adults. We found the relationship between wealth and mental health was persistent—from 2020 to 2023; that is, the relationship did not weaken. These findings contribute to a growing literature on economic inequity and poor mental health20,56. It is notable that gaps in mental health between accrued financial assets groups persisted over time despite record-breaking government investments in social and economic policy to support low-income groups during the COVID-19 pandemic. It is possible that in the absence of such social and economic policy, inequities could have widened, as suggested by cumulative inequality theory57. Even with population-level changes in symptoms of depression and anxiety over time, persons with lower accrued financial assets experienced a greater burden of poor mental health symptoms across all time periods. We also note that having accrued financial assets of $100,000 or more was associated with a lower odds ratio of a positive screen for depression or anxiety relative to all other accrued asset categories. The magnitude of the difference was similar across comparisons, suggesting that while the highest category was associated with improved mental health, there was not a meaningful difference in mental health across lower levels of accrued financial assets (e.g., $0-$4,999 compared to $65,000-$99,999) relative to $100,000 or more. It is possible that the lack of social safety net in the U.S. requires a high level of accrued financial assets to bestow psychological relief or that certain populations see a diminished health effect of assets58 due to larger structural forces that create health.

This paper adds to a small but growing literature34,35,54,59 that advocates for a more holistic representation of assets28,31 beyond income in understanding the relation between economic context and mental health. Wealth inequality, which includes inherited assets in addition to earned assets, is increasingly understood as one of core drivers of inequity between groups30. Having more assets may, for example, assist with coping in the face of stressors, leading to improved psychological outcomes60. Understanding the detailed elements that contribute to a person’s financial standing (such as through stocks of capital in addition to flows from income) may help explain inequities that widen due to political and social decisions that perpetuate economic inequity61,62, contributing to health disparities63.

These findings should be considered in light of four primary limitations. First, we used two screening instruments to measure mental health; while the PHQ-9 and GAD-7 have been validated in national cohorts to have high sensitivity and specificity43,44,64, the gold standard for the assessment of depression or generalized anxiety disorder are diagnoses made by health professionals. Second, as with all longitudinal studies, the CLIMB study had drop out across the four years of data collection. As such it is possible that there is selection bias based on participants who stayed in the sample. Third, economic measures were collected as categorical values based on thresholds in nominal dollars. Results should be interpreted as nominal, as opposed to real, changes in economic measures. Fourth, we are unable to determine the source of accrued financial assets. That is, adults could have accrued stock of financial assets through inherited wealth, sale of property, or excess income relative to expenses, which may each have different relations with mental health. However, given the paucity of literature on non-income financial assets and health, this study of financial assets broadly with mental health contributes to the literature, with future opportunities for research into details of stock accumulation and influence on mental health.

In summary, we found that having higher household accrued financial assets was significantly associated with symptoms of depression, anxiety, and their co-occurrence from 2020 to 2023. While the study was conducted during the COVID-19 pandemic, it is possible and consistent with literature from other time periods that these findings would hold during other times as well. These findings contribute to a growing literature that suggests that wealth matters even when taking into account income in driving mental health. Policies that address underlying economic factors65 and encourage the accrual of assets28, such that people can cover their expenses and save money over time, may help to improve population mental health.

Data for the CLIMB study are available upon reasonable request and consideration of the CLIMB study team. Requests should be sent to Dr. Ettman at cettman1@jhu.edu.

Goodwin, R. D., Weinberger, A. H., Kim, J. H., Wu, M. & Galea, S. Trends in anxiety among adults in the United States, 2008–2018: Rapid increases among young adults. J. Psychiatr. Res. 130, 441–446 (2020).

Article PubMed PubMed Central Google Scholar

Goodwin, R. D. et al. Trends in U.S. depression prevalence from 2015 to 2020: The widening treatment gap. Am. J. Prev. Med. 63, 726–733 (2022).

Article PubMed PubMed Central Google Scholar

Ettman, C. K. et al. Prevalence of depression symptoms in US adults before and during the COVID-19 pandemic. JAMA Netw. Open. 3, e2019686–e2019686 (2020).

Article PubMed PubMed Central Google Scholar

Czeisler, M. É. et al. Mental health, substance use, and suicidal ideation during the COVID-19 pandemic—United States, June 24–30, 2020. MMWR Morb Mortal. Wkly. Rep. 69, 1049–1057 (2020).

Article PubMed PubMed Central Google Scholar

Breslau, J. et al. A longitudinal study of psychological distress in the United States before and during the COVID-19 pandemic. Prev. Med. 143, 106362 (2021).

Article PubMed Google Scholar

Major Depression. National Institute of Mental Health (NIMH); published online Jan. (2022). https://www.nimh.nih.gov/health/statistics/major-depression (accessed April 12, 2022).

CDC National Center for Health Statistics. Mental Health – Household Pulse Survey – COVID-19. (2023). https://www.cdc.gov/nchs/covid19/pulse/mental-health.htm (accessed June 20, 2022).

Marx, W. et al. Major depressive disorder. Nat. Rev. Dis. Primers 9, 1–21 (2023).

Article Google Scholar

Hoge, E. A., Oppenheimer, J. E. & Simon, N. M. Generalized anxiety disorder: diagnosis and treatment. FOCUS 2, 346–359 (2004).

Article Google Scholar

Kessler, R. C. The costs of depression. Psychiatr. Clin. North Am. 35, 1–14 (2012).

Article PubMed Google Scholar

Greenberg, P. E. et al. The economic burden of adults with major depressive disorder in the United States (2010 and 2018). PharmacoEconomics 39: 653–65. (2021).

Hohls, J. K., König, H-H., Quirke, E. & Hajek, A. Anxiety, depression and quality of life—a systematic review of evidence from longitudinal observational studies. IJERPH 18, 12022 (2021).

Article PubMed PubMed Central Google Scholar

Brenes, G. A. Anxiety, depression, and quality of life in primary care patients. Prim. Care Companion J. Clin. Psychiatry 09, 437–443 (2007).

Article Google Scholar

Shirneshan, E. et al. Incremental direct medical expenditures associated with anxiety disorders for the U.S. adult population: evidence from the medical expenditure panel survey. J. Anxiety Disord. 27, 720–727 (2013).

Article PubMed Google Scholar

Krieger, N. Epidemiology and the web of causation: Has anyone seen the spider? Soc. Sci. Med. 39, 887–903 (1994).

Article PubMed Google Scholar

Kaplan, G. A. What’s wrong with social epidemiology, and how can we make it better? Epidemiol. Rev. 26, 124–135 (2004).

Article PubMed Google Scholar

Compton, M. T. & Shim, R. S. The social determinants of mental health. FOC 13, 419–425 (2015).

Article Google Scholar

Allen, J., Balfour, R., Bell, R. & Marmot, M. Social determinants of mental health. Int. Rev. Psychiatry 26, 392–407 (2014).

Article PubMed Google Scholar

Kawachi, I., Adler, N. E. & Dow, W. H. Money, schooling, and health: Mechanisms and causal evidence. Ann. N Y Acad. Sci. 1186, 56–68 (2010).

Article ADS PubMed Google Scholar

Lorant, V. et al. Socioeconomic inequalities in depression: A meta-analysis. Am. J. Epidemiol. 157, 98–112 (2003).

Article PubMed Google Scholar

Anxiety Disorders. National Institute of Mental Health (NIMH). accessed July 13, (2023). https://www.nimh.nih.gov/health/topics/anxiety-disorders

Pabayo, R., Kawachi, I. & Gilman, S. E. Income inequality among American states and the incidence of major depression. J. Epidemiol. Community Health 68, 110–115 (2014).

Article PubMed Google Scholar

Thomson, R. M. et al. How do income changes impact on mental health and wellbeing for working-age adults? A systematic review and meta-analysis. Lancet Public. Health 7, e515–e528 (2022).

Article PubMed PubMed Central Google Scholar

Apouey, B. & Clark, A. E. Winning big but feeling no better? The effect of lottery prizes on physical and mental health. Health Econ. 24, 516–538 (2015).

Article PubMed Google Scholar

Shields-Zeeman, L. & Smit, F. The impact of income on mental health. Lancet Public. Health 7, e486–e487 (2022).

Article PubMed Google Scholar

Ettman, C. K. et al. Assets, stressors, and symptoms of persistent depression over the first year of the COVID-19 pandemic. Sci. Adv. 8, eabm9737 (2022).

Article PubMed PubMed Central Google Scholar

Ettman, C. K. et al. Persistent depressive symptoms during COVID-19: A national, population-representative, longitudinal study of U.S. adults. Lancet Reg. Health – Americas 5, 100091 (2022).

Article PubMed Google Scholar

Ettman, C. K. & Galea, S. An asset framework to guide nonhealth policy for population health. JAMA Health Forum 5, e241485–e241485 (2024).

Article PubMed Google Scholar

Killewald, A., Pfeffer, F. T. & Schachner, J. N. Wealth inequality and accumulation. Ann. Rev. Sociol. 43, 379–404 (2017).

Article Google Scholar

Derenoncourt, E., Kim, C. H., Kuhn, M. & Schularick, M. Wealth of Two Nations: The U.S. Racial Wealth Gap, 1860–2020 (National Bureau of Economic Research, 2022).

Pollack, C. E. et al. Should health studies measure wealth? A systematic review. Am. J. Prev. Med. 33, 250–264 (2007).

Article PubMed Google Scholar

Ettman, C. K., Cohen, G. H. & Galea, S. Is wealth associated with depressive symptoms in the United States? Ann. Epidemiol. 43, 25–31e1 (2020).

Article PubMed PubMed Central Google Scholar

Carter, K. N., Blakely, T., Collings, S., Gunasekara, F. I. & Richardson, K. What is the association between wealth and mental health? J. Epidemiol. Community Health 63, 221–226 (2009).

Article PubMed Google Scholar

Ettman, C. K. et al. Wealth and depression: a scoping review. Brain Behav. 12 https://doi.org/10.1002/brb3.2486 (2022).

Ettman, C. K. et al. Assets and depression in U.S. adults during the COVID-19 pandemic: A systematic review. Soc Psychiatry Psychiatr Epidemiol; published online Oct 15. DOI: (2023). https://doi.org/10.1007/s00127-023-02565-2

Ensel, W. M. & Lin, N. The life stress paradigm and psychological distress. J. Health Soc. Behav. 32, 321 (1991).

Article PubMed Google Scholar

Kessler, R. C. The effects of stressful life events on depression. Annu. Rev. Psychol. 48, 191–214 (1997).

Article PubMed Google Scholar

Kendler, K. S., Karkowski, L. M. & Prescott, C. A. Causal relationship between stressful life events and the onset of major depression. AJP 156, 837–841 (1999).

Article Google Scholar

Ettman, C. K. et al. Financial strain and depression in the U.S.: A scoping review. Translational Psychiatry 13 https://doi.org/10.1038/s41398-023-02460-z (2023).

Schneiderman, N., Ironson, G. & Siegel, S. D. Stress and health: Psychological, behavioral, and biological determinants. Annu. Rev. Clin. Psychol. 1, 607–628 (2005).

Article PubMed PubMed Central Google Scholar

Mullainathan, S. & Shafir, E. Scarcity: Why Having too Little Means so much, First Edition (Times Books, Henry Holt and Company, 2013).

Wilkinson, L. R. Financial strain and mental health among older adults during the great recession. Geronb 71, 745–754 (2016).

Article Google Scholar

Kroenke, K., Spitzer, R. L. & Williams, J. B. W. The PHQ-9: Validity of a brief depression severity measure. J. Gen. Intern. Med. 16, 606–613 (2001).

Article PubMed PubMed Central Google Scholar

Spitzer, R. L., Kroenke, K., Williams, J. B. W. & Löwe, B. A brief measure for assessing generalized anxiety disorder: The GAD-7. Arch. Intern. Med. 166, 1092 (2006).

Article PubMed Google Scholar

Schlax, J. et al. Income and education predict elevated depressive symptoms in the general population: Results from the Gutenberg health study. BMC Public. Health 19, 430 (2019).

Article PubMed PubMed Central Google Scholar

Guerrini, C. J. et al. Psychological distress among the U.S. general population during the COVID-19 pandemic. Front. Psychiatry 12, 642918 (2021).

Article PubMed PubMed Central Google Scholar

White, G. E., Mair, C., Richardson, G. A., Courcoulas, A. P. & King, W. C. Alcohol use among U.S. adults by weight status and weight loss attempt: NHANES, 2011–2016. Am. J. Prev. Med. 57, 220–230 (2019).

Article PubMed Google Scholar

Matta, S., Chatterjee, P. & Venkataramani, A. S. The income-based mortality gradient among US Health Care Workers: Cohort Study. J. Gen. Intern. Med. 36, 2870–2872 (2021).

Article PubMed Google Scholar

System of national accounts. Rev. 5. New York: United Nations, 2009. (2008).

Zamarro, G. & Prados, M. J. Gender differences in couples’ division of childcare, work and mental health during COVID-19. Rev. Econ. Househ. 19, 11–40 (2021).

Article PubMed PubMed Central Google Scholar

Serrano-Alarcón, M., Kunst, A. E., Bosdriesz, J. R. & Perelman, J. Tobacco control policies and smoking among older adults: A longitudinal analysis of 10 European countries. Addiction 114, 1076–1085 (2019).

Article PubMed PubMed Central Google Scholar

Carey, N., Coley, R. L., Hawkins, S. S. & Baum, C. F. Emerging adult mental health during COVID: Exploring relationships between discrete and cumulative individual and contextual stressors and well-being. Journal of Adolescent Health; published online March 14. DOI: (2024). https://doi.org/10.1016/j.jadohealth.2024.01.031

Headey, B. & Wooden, M. The effects of Wealth and Income on Subjective Well-Being and Ill-Being. Economic Record 80, S24–33 (2004).

Article Google Scholar

Bialowolski, P., Xiao, J. J. & Weziak-Bialowolska, D. Do All Savings Matter Equally? Saving Types and Emotional Well-Being Among Older Adults: Evidence from Panel Data. J Fam Econ Iss ; published online March 20. DOI: (2023). https://doi.org/10.1007/s10834-023-09891-2

Kourouklis, D., Verropoulou, G. & Tsimbos, C. The impact of wealth and income on the depression of older adults across European welfare regimes. Ageing Soc., 1–32. (2019).

Patel, V. et al. Income inequality and depression: A systematic review and meta-analysis of the association and a scoping review of mechanisms. World Psychiatry 17, 76–89 (2018).

Article PubMed PubMed Central Google Scholar

Bask, M. & Bask, M. Cumulative (dis)advantage and the Matthew Effect in life-course analysis. PLoS ONE 10, e0142447 (2015).

Article PubMed PubMed Central Google Scholar

Assari, S. Unequal gain of Equal resources across racial groups. Int. J. Health Policy Manag. 7, 1–9 (2018).

Article ADS PubMed Google Scholar

Bialowolski, P. et al. The role of financial conditions for physical and mental health. Evidence from a longitudinal survey and insurance claims data. Soc. Sci. Med. 281, 114041 (2021).

Article PubMed Google Scholar

Lazarus, R. S., Folkman, S. & Stress Appraisal, and Coping, 1st edition. New York: Springer Publishing Company, (1984).

Desmond, M. Poverty, by America, First Edition (Crown, 2023).

Piketty, T. & Rendall, S. A Brief History of Equality (Belknap Press of Harvard University, 2022).

Case, A. & Deaton, A. Deaths of Despair and the Future of Capitalism (Princeton University Press, 2020).

Kroenke, K., Spitzer, R. L., Williams, J. B. W., Monahan, P. O. & Löwe, B. Anxiety disorders in primary care: Prevalence, impairment, comorbidity, and detection. Ann. Intern. Med. 146, 317 (2007).

Article PubMed Google Scholar

Nykiforuk, C. I. J. et al. An action-oriented public health framework to reduce financial strain and promote financial wellbeing in high-income countries. Int. J. Equity Health 22, 66 (2023).

Article PubMed PubMed Central Google Scholar

Download references

The authors would like to thank Emma Dewhurst for helpful conversations on wealth and mental health, Dr. C. Ross Hatton for research assistance, and Priya Dohlman for research assistance and copy-editing.

CLIMB Wave 1 was supported by the Rockefeller-Boston University Commission on Social Determinants, Data and Decision Making. CLIMB Waves 2–4 were supported by the de Beaumont Foundation.

Department of Health Policy and Management, Johns Hopkins Bloomberg School of Public Health, Baltimore, MD, USA

Catherine K. Ettman, Ben Thornburg & Mark K. Meiselbach

Department of Global Health, Boston University School of Public Health, Boston, MA, USA

Salma M. Abdalla & Sandro Galea

Office of the Dean, Boston University School of Public Health, Boston, MA, USA

Sandro Galea

You can also search for this author in PubMed Google Scholar

You can also search for this author in PubMed Google Scholar

You can also search for this author in PubMed Google Scholar

You can also search for this author in PubMed Google Scholar

You can also search for this author in PubMed Google Scholar

C.K.E. conceived the project, acquired the data, interpreted the data, and drafted the manuscript. B.T. conducted data analysis, interpreted data, and drafted the manuscript. S.M.A. supported acquisition of the data through funding and reviewed the draft manuscript. M.K.M. contributed to analysis strategy, interpreted the data, and reviewed the draft manuscript. S.G. acquired the data, interpreted the data and reviewed the manuscript. All authors reviewed the manuscript.

Correspondence to Catherine K. Ettman.

The authors declare no competing interests.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Below is the link to the electronic supplementary material.

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

Reprints and permissions

Ettman, C.K., Thornburg, B., Abdalla, S.M. et al. Financial assets and mental health over time. Sci Rep 14, 27370 (2024). https://doi.org/10.1038/s41598-024-76990-x

Download citation

Received:

Accepted:

Published:

DOI: https://doi.org/10.1038/s41598-024-76990-x

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

Advertisement

© 2024 Springer Nature Limited

Sign up for the Nature Briefing newsletter — what matters in science, free to your inbox daily.